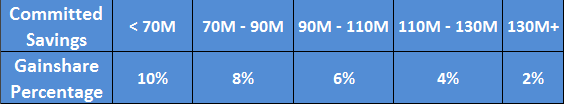

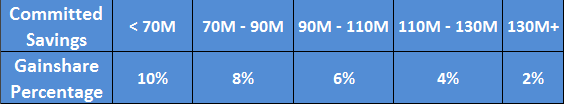

The concept behind the city of Chicago’s contract with Accenture is “Gainshare”, meaning Accenture receives a percentage of the savings achieved by the city. In this case, the fee structure allows for compensation of 10% of savings up to $70 million, tapering downwards after that.

In theory, this type of arrangement means that the city can only come out ahead - or at worst, even (if no savings can be found). However, contingency can be a tricky concept and several questions need to be answered to validate the budget-neutral or budget-positive theory, including how is savings defined, how is it calculated and most importantly, when is it billed for?

The question of how savings are defined is spelled out in detail in the contract. Rather than use the contract terminology, which is needlessly cumbersome, I will use “common folk” speak to explain it. Under the agreement, before sourcing begins, spend is analyzed by project area and a baseline report is provided to the City. This baseline report spells out current price points down to an SKU level, and is intended to be a “Total Cost of Ownership” assessment including service levels, price change mechanisms, contractual requirements, and any other relevant information. The report also provides the strategies that will be employed to achieve savings for the project area. The City has ten days to review and approve or dispute the report, and then sourcing begins. This report is intended to be the basis for all future savings calculations and projections.

After market research, sourcing and negotiations are complete, a new report is created that provides the City with the savings options. The City now has ten days to approve or dispute the opportunity, after which the savings is considered “Value Committed” and Accenture is due their “Value Based Fees” of 10% of forecasted savings.

So when is Accenture due its 10% of savings? After a contract is executed with a new vendor? After implementation? After testing and approval of an alternative specification? No. Accenture bills their fee, in whole, 2 months after they present the savings opportunity to the City. And that’s where the major problems with this agreement start.

The actual language states that :

Why not? Well, as Peter Smith referenced on Spend Matters, right now the city has no current picture of spending. With a procurement team that has no real tracking or controls in place currently, how are concepts such as preferred supplier utilization, consolidation, product substitution, and inventory management, not to mention ongoing supplier account management, SLA Maintenance and operational process improvements supposed to take place?

Sure, some may say that Rahm Emanuel is tough, and he will mandate the change necessary. But as we’ve mentioned in previously blog posts, an Aberdeen study has shown that even in companies with shareholder responsibilities and monthly/quarterly/annual P&L goals, 66% of savings go unrealized.

The reality is identifying savings is the easy part! Most markets have competition, and leveraging offers and negotiating pricing is basically a tactical skill. The real challenge of strategic sourcing is change management - getting your own people to make the changes necessary to implement and sustain the savings opportunity. In this case, Accenture isn’t on the hook for the hard part; they get their fee when savings are identified.

Assuming only one out of every three savings dollars identified are actually implemented, the real fee to Accenture is closer to 30% of savings. Even 30% is not bad, but it’s also no guarantee. In a government setting, many savings opportunities may get squandered altogether. If a consulting firm is getting paid based on savings, it should have some responsibility for ensuring the savings are implemented, and the responsibility of tracking should go to them as well. Contingency is supposed to be about the consultant taking on risk in exchange for a reward. Unfortunately in this agreement, all the risk remains with the customer, with no guaranteed reward. But Accenture tries to paint the picture otherwise in the contract terms:

------

Part 1 - an intro

Part 2 - term confusion

Part 4 - Audit and Tracking

Part 5 - Responsibilities

Part 6 - Calculating Savings

Part 7 - Understanding Termination Clauses and Penalties

Part 8 - Will Taxpayers Get What Was Promised?

Part 9 - What Reason Did We Analyze This For?

In theory, this type of arrangement means that the city can only come out ahead - or at worst, even (if no savings can be found). However, contingency can be a tricky concept and several questions need to be answered to validate the budget-neutral or budget-positive theory, including how is savings defined, how is it calculated and most importantly, when is it billed for?

The question of how savings are defined is spelled out in detail in the contract. Rather than use the contract terminology, which is needlessly cumbersome, I will use “common folk” speak to explain it. Under the agreement, before sourcing begins, spend is analyzed by project area and a baseline report is provided to the City. This baseline report spells out current price points down to an SKU level, and is intended to be a “Total Cost of Ownership” assessment including service levels, price change mechanisms, contractual requirements, and any other relevant information. The report also provides the strategies that will be employed to achieve savings for the project area. The City has ten days to review and approve or dispute the report, and then sourcing begins. This report is intended to be the basis for all future savings calculations and projections.

After market research, sourcing and negotiations are complete, a new report is created that provides the City with the savings options. The City now has ten days to approve or dispute the opportunity, after which the savings is considered “Value Committed” and Accenture is due their “Value Based Fees” of 10% of forecasted savings.

So when is Accenture due its 10% of savings? After a contract is executed with a new vendor? After implementation? After testing and approval of an alternative specification? No. Accenture bills their fee, in whole, 2 months after they present the savings opportunity to the City. And that’s where the major problems with this agreement start.

The actual language states that :

“Accenture’s Value Based Fees shall be accrued against the Gainshare Percentage of Committed Savings expected to arise from a UVE during the life of the contract with the vendor following implementation and the start of benefits being received by the City of Chicago as confirmed by the Value Committed Milestone. For contracts with a life of greater than 24 months, the Value Based Fees will be capped based on Committed Savings over the first 24 months of the contract. “Under this scenario, Accenture receives their 10%, up front, based on a 2 year projection that requires the City to take full advantage of 100% of the savings opportunities identified. The likelihood of 100% compliance and actual savings being the same as forecasted is not very high.

Why not? Well, as Peter Smith referenced on Spend Matters, right now the city has no current picture of spending. With a procurement team that has no real tracking or controls in place currently, how are concepts such as preferred supplier utilization, consolidation, product substitution, and inventory management, not to mention ongoing supplier account management, SLA Maintenance and operational process improvements supposed to take place?

Sure, some may say that Rahm Emanuel is tough, and he will mandate the change necessary. But as we’ve mentioned in previously blog posts, an Aberdeen study has shown that even in companies with shareholder responsibilities and monthly/quarterly/annual P&L goals, 66% of savings go unrealized.

The reality is identifying savings is the easy part! Most markets have competition, and leveraging offers and negotiating pricing is basically a tactical skill. The real challenge of strategic sourcing is change management - getting your own people to make the changes necessary to implement and sustain the savings opportunity. In this case, Accenture isn’t on the hook for the hard part; they get their fee when savings are identified.

Assuming only one out of every three savings dollars identified are actually implemented, the real fee to Accenture is closer to 30% of savings. Even 30% is not bad, but it’s also no guarantee. In a government setting, many savings opportunities may get squandered altogether. If a consulting firm is getting paid based on savings, it should have some responsibility for ensuring the savings are implemented, and the responsibility of tracking should go to them as well. Contingency is supposed to be about the consultant taking on risk in exchange for a reward. Unfortunately in this agreement, all the risk remains with the customer, with no guaranteed reward. But Accenture tries to paint the picture otherwise in the contract terms:

“The City of Chicago agrees and recognizes that Accenture is taking considerable risks on the City’s behalf by allowing a deferred gain share payment instead of a fixed fee schedule.”Next week, in our next post on this topic, Bill will provide some context to who is actually tracking the savings, and what happens in a year if Chicago looks back and sees that the budget is still bloated. In future posts we will cover the types of savings that are billable by Accenture and answer the question: Are Chicago taxpayers likely to get what they pay for?

------

Part 1 - an intro

Part 2 - term confusion

Part 4 - Audit and Tracking

Part 5 - Responsibilities

Part 6 - Calculating Savings

Part 7 - Understanding Termination Clauses and Penalties

Part 8 - Will Taxpayers Get What Was Promised?

Part 9 - What Reason Did We Analyze This For?

Post A Comment:

0 comments so far,add yours