States are trying to figure out new and creative ways to supplement their ever shrinking budgets and offset their continuously expanding debt. Across the country, states are slashing spending, laying off employees, and increasing taxes wherever possible. Well in order to battle this and boost revenue, some states have realized people may pay top dollar for specific vanity license plates.

For decades, most states charged a minimal additional fee for customized plates – anywhere from $5 to $25. (In Pennsylvania the fee is currently $20). In recent years, states began raising these fees and proposing annual fee hikes. Well in these dire times, states like Texas have taken this a step further with auctioning off specific vanity plates. This year, in the country’s first vanity plate auction, the state of Texas earned $139,400 from selling these. A “PORSCHE” plate sold for $7,500 and a "FERRARI” plate sold for an amazing $15,000. The potential revenue growth for this market is enormous, especially in the U.S. Despite having 9.3 million motor vehicles with vanity plates, the 46 states that charged annual fees for them collectively raised only about $177 million, according to a 2007 study by the American Association of Motor Vehicle Administrators.

The U.S. state with the highest number of registered vanity plates was Virginia, with 16% of all vehicles, the 2007 study found. New Hampshire was second, followed by Illinois. The state with the lowest rate at the time was Texas at 0.56%. Texas has hired a private company to run and market these vanity plate auctions to raise $25 million over the next five years.

Other countries have already tapped this revenue stream with big results. A businessman in Abu Dhabi bought a license plate with "1" at an auction for $14.3 million in 2008. That of course was a critical investment in himself – before it was unclear, but now everyone truly knows who exactly is number 1 in the United Arab Emirates. Last year, in England, a retired businessman bought "1 RH" -- his initials -- for about $400,000. Hong Kong sold a plate that read "STORAGE" for $12,000.

Clearly low numbered plates offer their drivers ultimate prestige. But people often get customized plates for many different reasons – mostly as a way of self-expression. For example, using a vanity plate to let others know your likes and dislikes (“LUV2FRT,” “IH8CATS”), musical preferences (“8675309”), how you feel about them (“URATOOL”), how you feel about their parents (“LVURMOM”), your marital status (“D-WIFED,” “WUZ HIZ”), or just your overall level of nerdiness (“DCPTCON”).

People also use them as a way to attract the opposite sex – which I am sure works great although I was unable to find any empirical evidence. You have to be very careful with what plate you choose or end up with. You never know – you could mistakenly get the wrong vanity plate like Kramer did from Seinfeld – from a proctologist whose plate read “ASSMAN.” I wonder how much that one would go for at auction.

For decades, most states charged a minimal additional fee for customized plates – anywhere from $5 to $25. (In Pennsylvania the fee is currently $20). In recent years, states began raising these fees and proposing annual fee hikes. Well in these dire times, states like Texas have taken this a step further with auctioning off specific vanity plates. This year, in the country’s first vanity plate auction, the state of Texas earned $139,400 from selling these. A “PORSCHE” plate sold for $7,500 and a "FERRARI” plate sold for an amazing $15,000. The potential revenue growth for this market is enormous, especially in the U.S. Despite having 9.3 million motor vehicles with vanity plates, the 46 states that charged annual fees for them collectively raised only about $177 million, according to a 2007 study by the American Association of Motor Vehicle Administrators.

The U.S. state with the highest number of registered vanity plates was Virginia, with 16% of all vehicles, the 2007 study found. New Hampshire was second, followed by Illinois. The state with the lowest rate at the time was Texas at 0.56%. Texas has hired a private company to run and market these vanity plate auctions to raise $25 million over the next five years.

Other countries have already tapped this revenue stream with big results. A businessman in Abu Dhabi bought a license plate with "1" at an auction for $14.3 million in 2008. That of course was a critical investment in himself – before it was unclear, but now everyone truly knows who exactly is number 1 in the United Arab Emirates. Last year, in England, a retired businessman bought "1 RH" -- his initials -- for about $400,000. Hong Kong sold a plate that read "STORAGE" for $12,000.

Clearly low numbered plates offer their drivers ultimate prestige. But people often get customized plates for many different reasons – mostly as a way of self-expression. For example, using a vanity plate to let others know your likes and dislikes (“LUV2FRT,” “IH8CATS”), musical preferences (“8675309”), how you feel about them (“URATOOL”), how you feel about their parents (“LVURMOM”), your marital status (“D-WIFED,” “WUZ HIZ”), or just your overall level of nerdiness (“DCPTCON”).

People also use them as a way to attract the opposite sex – which I am sure works great although I was unable to find any empirical evidence. You have to be very careful with what plate you choose or end up with. You never know – you could mistakenly get the wrong vanity plate like Kramer did from Seinfeld – from a proctologist whose plate read “ASSMAN.” I wonder how much that one would go for at auction.

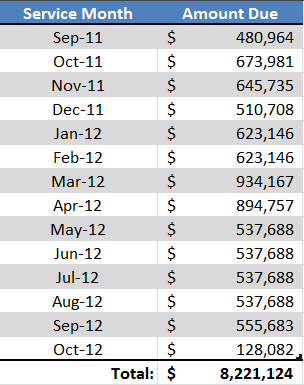

The minimum termination schedule is telling in that it gives an indication of how much, minimally, Accenture expects to make on the deal over the next year- $8.2 million. Anything above this amount will be gravy.

The minimum termination schedule is telling in that it gives an indication of how much, minimally, Accenture expects to make on the deal over the next year- $8.2 million. Anything above this amount will be gravy.